The strategy that reminds us of the importance of dividends.

Stock markets around the globe saw a difficult year, with fears of inflation, rising rates, and supply chain issues swirling around the economy and markets all year. Seven interest rate hikes from the Fed, 40-year inflation highs, a cooling off housing market, slowing manufacturing, and a war in Ukraine all provided a steady – if not howling – wind blowing against the markets all year. When investors review their account statements for the year, they will see that there really were no places to hide, as the stock and bond markets set records that we won’t soon forget:

- For equity investors, 2022 brought the biggest losses since the 2008 great financial crisis.

- For bond investors, this was the worst year on record for the Barclay’s U.S. Aggregate Bond Index since it began over 45 years ago.

Remembering the Dogs of the Dow

The Dow Jones Industrial Index is one of the most widely-followed benchmarks for tracking U.S. stocks and market performance. It is made up of 30 large publicly traded companies in the U.S., which are selected by Dow Jones & Company based on their market capitalization, liquidity, and industry sector representation.

The Dogs of the Dow strategy involves buying an equal dollar amount in the 10 highest-yielding Dow stocks. First, you purchase these stocks at the start of each year. Then, you must hold them for a year. Finally, at the end of the year, you must repeat the process. You sell the previous year’s picks and buy the new highest-yielding stocks. One variation of the process is buying and holding the stocks for a year + 1 month to collect dividends. Another variation involves rebalancing quarterly.

The Dogs of the Dow Did Well in 2022

Over the years, the Dogs of the Dow strategy has generated mixed results. However, in a year like 2022, dividends really made a difference. In fact, in 2022 the Dogs of the Dow outperformed the Dow Jones Industrial Index, returning +2.2% versus -8.8% for the DJIA. You can attribute this strong performance to DJIA components like IBM, Chevron, Merck, Amgen, and Coca-Cola, which all posted gains last year. Chevron, for example, jumped a staggering 53% in addition to yielding 4.6%.

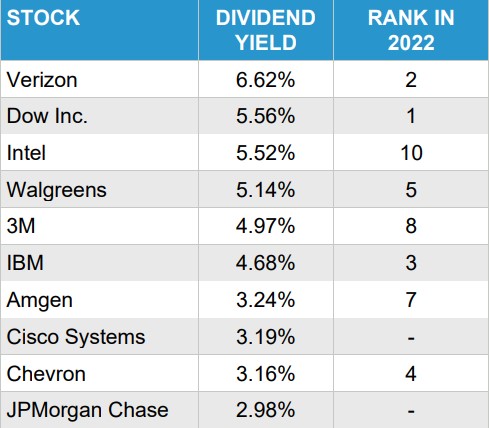

The 2023 Dogs of the Dow

Looking ahead, the 2023 Dow Dogs of the Dow strategy may continue to outperform the DJIA – but it might not. If it does, it will likely be due to the attractive dividend yields that these stocks offer.

Overall, Dogs of the Dow can offer investors a unique way to gain exposure to U.S. stocks while taking advantage of attractive dividend yields and potential upside from investing in Dow components. While you might consider this strategy, before making any changes, make sure you talk to your financial advisor.