Understanding Capital Gains, new IRS Mileage Rates, and what the IRS will never do.

Getting out of the market because of Taxes? Are you considering bailing out of stocks, thinking the capital gains tax structure might change? Before you hit the sell button, think it over carefully and make sure you truly understand the tax implications – especially the differences between short and long-term capital gains. Capital gains taxes are essentially separated into one of two categories: short-term and long-term. As you might surmise, the category that applies to you depends on how long you’ve held the assets.

- Short-term capital gains taxes are applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are aligned with where your income places you in federal tax brackets. In other words, you pay the same rate as you would on ordinary income taxes.

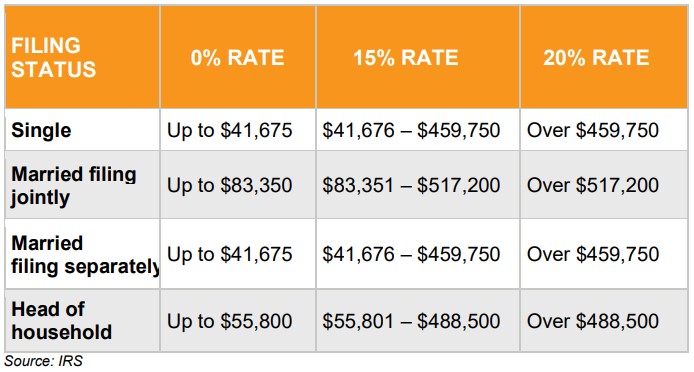

- Long-term capital gains taxes are applied to assets held for more than a year. The long-term capital gains tax rates are 0%, 15%, and 20%, depending on your income. These rates are lower than ordinary income tax rates.

Long-Term Capital Gains Tax Rates

The tax rate on most net capital gains is no higher than 15% for most individuals. However, if you are a high-earner, you might fall into the 20% long-term cap gain bracket.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

- The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

2023 Mileage Rates Announced

The IRS issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving purposes. Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups, or panel trucks) will be:

- 5 cents per mile driven for business use, up 3 cents from the midyear increase setting the rate for the second half of 2022.

- 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, consistent with the increased midyear rate set for the second half of 2022.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2022.

In addition, the IRS announced that:

- These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

- The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on variable costs.

- It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. They also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station.

- Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

- Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.”

Remember, the IRS will never…

Call to demand immediate payment using a specific payment method. Generally, the IRS will first mail you a bill if you owe any taxes. Additionally, the IRS will never:

- Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Ask for credit or debit card numbers over the phone.

Although Congress continues to pass large economic bills, no single bill can account for every unique situation. Worse, the federal tax code is crazily long. At over 2,500 pages, it is 5x the length of the Grapes of Wrath, written by John Steinbeck. Before you go down a path that might not be in your best interest, make sure you consult with your financial advisor. They will help you determine how any new tax changes, or proposed tax changes, might impact you and your family.