What impact would rising interest rates have on your investment portfolio?

Likely not as bad as the media might lead you to believe, especially when it comes to the purchase of a bond. According to a recent survey by the Wall Street Journal, the 10-year Treasury yield was predicted to rise by 1% at the end of 2022 to about 5%. We don’t have to look that far into the past to find the historical inaccuracy of such forecasts. A similar survey conducted in 2010 had economists predicting a 4.20% 10-year Treasury yield by the end of the year. At the time of the forecast, the rate was 3.61%. By the end of the year, rates declined to 3.30%.

A study by North Carolina State professors titled “Professional Forecasts of Interest Rates and Exchange Rates” found economists predict future rates far less accurately than random coin flip fares as a predictor. We can’t be confident exactly what interest rates will do in 2022 or 2023 – and while predictions of rising rates will likely come true – predicting the extent to which they rise is as difficult as predicting future stock market levels.

Why a Bond Might Make Sense

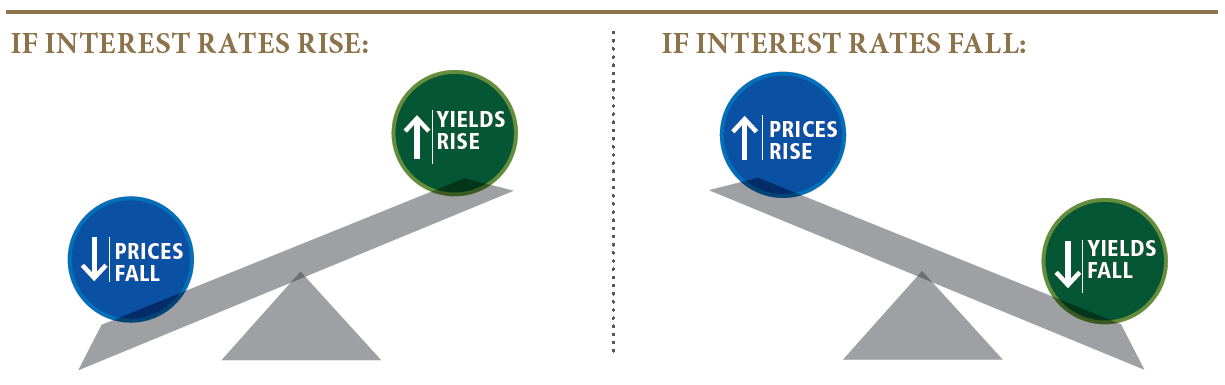

One point that investors should remember, however, is that bond yields move in the opposite direction of prices. The phenomenon is known as interest rate risk. In addition, investors should never forget the value bonds add to a portfolio as a diversifier to stocks. Frequently, the performance of stocks and bonds are inversely related. Depending on your goals, it doesn’t seem prudent to avoid bonds entirely during periods of expected interest rate increases.

- First, precise forecasts of rising rates are far from certain.

- Second, even as interest rates rise, bonds are still likely to be far less risky than stocks.

- Third, rising interest rates don’t necessarily mean declining bond values are a certainty.

Finally, bonds are a vitally important part of a diversified portfolio, and owning uncorrelated and negatively correlated assets is critical when equities ultimately lose their luster.