The beaten-down sectors from 2022 might be worth another look in 2023.

In general terms, the bond market will rally when increases in the Consumer Price Index (inflation) are small and the bond market will fall when increases in the CPI are large. The equity markets generally follow the same trend as the bond market when responding to CPI numbers. In other words, the equity market will (generally) rise when CPI numbers are small because low inflation leads to low-interest rates, which are good for corporate profits. But are there certain S&P 500 sectors to consider that might perform better if inflation rises?

Inflation Rose in November and December

On January 12th, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index increased 6.5% over the past 12 months. Shockingly, media outlets ran with absurd headlines like these: “Annual Inflation Slowed to 6.5%” and “December CPI Report Shows Cooling Inflation” and even this one: “December’s ‘very favorable’ inflation read could signal the ‘final phase of the bear market’ and stave off a recession.”

Ok, maybe it’s technically true that inflation declined 0.1% in December, but annual inflation of more than 6% is still very high. Maybe this will hit home more: that 10% return on your portfolio is not 10% after 6.5% inflation. Not even close. Most importantly, you should remember this: Inflation can do a number on retirees’ incomes. Most people don’t think about that, but with longer lifespans, we run a real risk of seeing our retirement savings eaten away. Curbing its impact takes planning.

Where to Invest During Rising Inflation

Generally speaking, financial advisors would suggest that cash is one of the worst asset classes to hold during rising inflationary periods. And in theory, there are some sectors that generally perform better than others if inflation rises.

For example, when there is high inflation, companies will pass the rising costs onto consumers, right? And it stands to reason that if you and I become more selective when we purchase goods and services, we might forgo some luxury items (think jewelry), but we will keep buying basic necessities (like bread and milk). And that explains why the Consumer Staples sector generally performs better during rising inflationary periods and the Consumer Discretionary sector generally performs worse.

Energy (Oil and Oil Stocks)

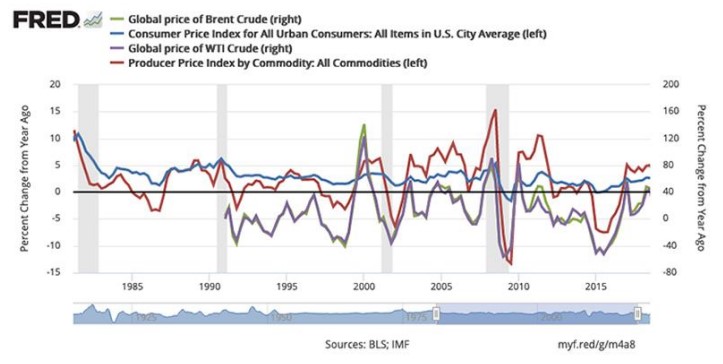

Interestingly, there is a positive correlation between the price of oil and inflation. In fact, according to the St. Louis Federal Reserve: “The graph shows a strong positive relationship between oil prices and PPI inflation: That is, you can associate higher oil prices with higher producer prices and vice versa. Specifically, the correlation between oil prices and the PPI is 0.71. This strong link likely comes from the importance of oil as an input in the production of goods.

Utilities Sector

Many consider utilities to be defensive as we all still need them (think electricity, heat, gas, etc.) no matter the inflationary environment. And since energy companies pass any higher costs onto us, they are able to maintain their profitability.

Real Estate Sector

The Real Estate sector is often a hedge against inflation too. Consider the largest component of the sector – Real Estate Investment Trusts. REITs own and operate income-producing real estate and property prices and rental income tend to rise when inflation rises. Further, REIT, by law, must pay out at least 90% of its net earnings to shareholders annually.

Allocations Matter

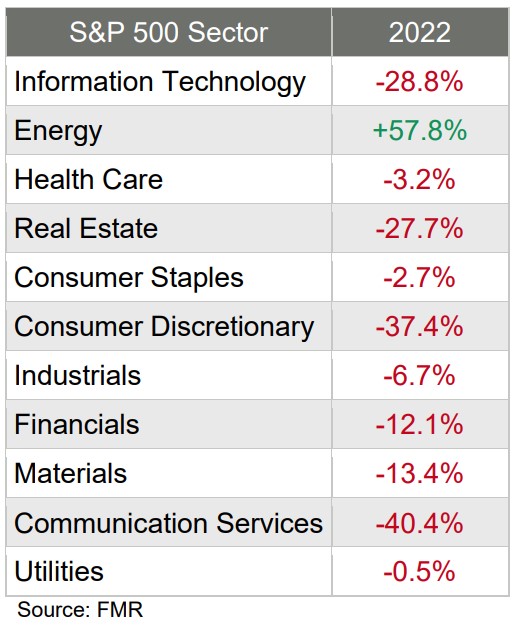

Want more proof of the importance of asset allocation and diversification in one’s portfolio returns? Consider the performance of the sectors just mentioned last year:

Notice a pattern? Again, those variations are the epitome of sector rotation, and the numbers empirically identify the importance of asset allocation and diversification for all investors. But last year’s sector performance might suggest that if inflation does indeed remain high in 2023, last year’s beaten-down sectors might be worth another look.