Warren Buffett will leave his wife’s money allocated conservatively: 90% in the Standard & Poor’s 500 and 10% in short-term Treasuries, frozen at those levels.

Warren Buffett believes this allocation is a great idea for the average person without financial prowess. But is it? Buffett advocates a buy-and-hold philosophy, saying his “favorite holding period is forever.”Warren Buffett says his 90-10, S&P 500/Treasuries breakdown for his wife will achieve results “superior to those attained by most investors.” In many respects, most financial advisors would say that Warren’s bequest for his wife is an excellent directive, particularly for his wife or a person with either:

- a long-term (at least 25 years) to invest or

- a substantial estate (in this case, multiple billions of dollars) that can withstand potentially 50% to 80% drawdowns occasionally.

His wife can afford to place so much faith in the S&P 500. Others cannot.

Blind Faith in the S&P 500

One reason to avoid blind faith in the S&P 500 is that too many individual investors invest poorly, dodging in and out of stocks at a whim or chasing the latest trends. Trying to sell at the peaks and buy at the bottom is almost guaranteed to underperform. But perhaps the most convincing reason is that Buffett does not manage his or his shareholders’ money using the buy-and-hold directive in his will. He runs Berkshire’s portfolio using aggressive market timing to buy attractive assets at distressed prices and selling when valuations become full.

In addition, because of the large asset size and clout of Berkshire Hathaway, Buffett is often able to enhance returns with favored securities including warrants, attractive borrowing terms, and lowered acquisition costs. These strategies are only available to him and his conglomerate. Buffett’s entire career has been based on actively managing his portfolio to mitigate risk and take advantage of above-average investment opportunities.

What’s important to stress here is that Buffett’s wife, Latvian-born Astrid Menks, is not like many investors. Her husband is one of the wealthiest people on earth. If the portion of the assets devoted to the S&P 500 suddenly dropped in value to zero, it likely would have little effect on her daily life.

The Buy and Hold Approach

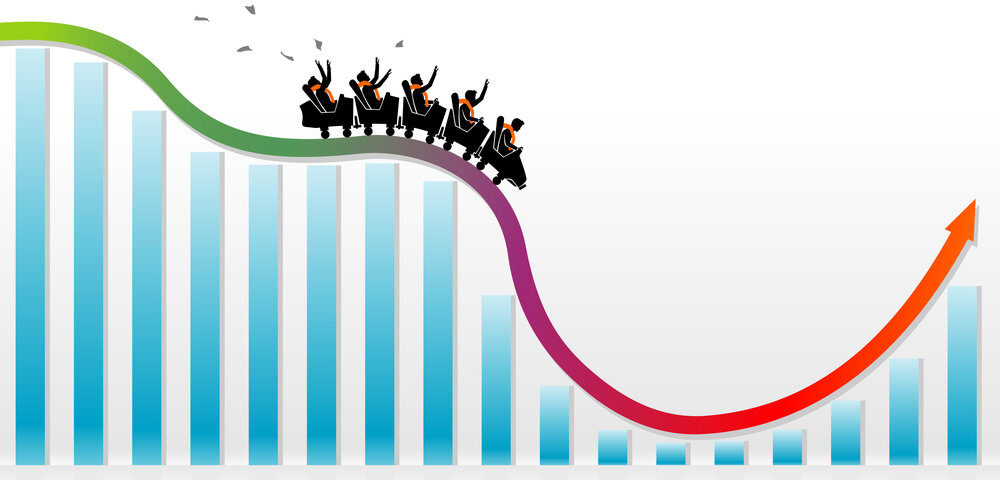

When you use a buy-and-hold approach, based on what has happened since 1896, you can only be sure of recovering your principal if you have an investment time frame of at least 25 years.

- Buyers of the market in 1929 had to wait until 1954 to break even.

- Investors who bought the market in 1965 did not recover their principal until 1982.

- From 2000 to 2013, many buy-and-hold investors suffered a loss.

- Buyers of the NASDAQ in 2000 did not breakeven until about 2007.

Many of us may need to spend the funds in our accounts before the end of the next quarter century. As a result, maybe you require a more active approach to avoiding major market downturns. It’s unacceptable to many of us to invest for ten years or more, only to be down or flat. The account size is also a protection against suffering real-world consequences of negative volatility. Starting with billions or millions of dollars allows for more risk-taking. A multi-billion/million-dollar account can lose most of its value and yet not impair the owner’s ability to afford a satisfactory lifestyle.

Excess wealth allows the account holder to ride out the downturn in relative comfort and have an opportunity to recoup losses over time. Most Americans, if they lost half of their liquid net worth, know their living standards would suffer. This is especially true in a time of relatively stagnant wage and employment growth, thanks to technological advancement. As we age and as high-paying job opportunities shrink, our largest earnings engine asset shifts from our pay to our savings.

Active Risk Mitigation

Many of us require active risk mitigation to avoid a major loss of principal and agile asset management to participate in bullish markets. That entails active management but with eyes wide open to both perils and opportunities. To achieve the combination of both protection and growth, Warren Buffett’s will directive is not suitable for many of us. At the same time, trading on emotion or chasing performance are strategies that have proven over time to lead to substantial underperformance. Talk to your advisor and make sure you have a plan.