ROTH 401(K) TO A ROTH IRA ROLLOVER

As retirement account questions go, this is the shortest inquiry with the longest answer. When asked what factors to consider and what 5-year clocks apply with a Roth 401(k) to Roth IRA rollover, I take a big breath and say, “Pull up a chair.” There are several variables to determine. [...]

GOV REPORT HIGHLIGHTS 401(K) CONFUSION

A recent government report highlights how confused 401(k) participants are when they have to decide what to do with their savings after leaving employment. Tax rules require 401(k) plans (and 403(b) and governmental 457(b) plans) to provide a written notice when participants become entitled to a distribution that can be rolled [...]

FIVE RMD FACTS IRA OWNERS SHOULD KNOW

If you have an IRA and you are approaching retirement age, you have probably heard the term “required minimum distribution” (RMD). But do you know the details of how the rules work and what they mean for you? Here are five facts about RMDs that every IRA owner should know. [...]

WHEN A REVERSE ROLLOVER MAKES SENSE

In a famous “Seinfeld” episode, George Costanza, unemployed, living with his parents and without a girlfriend, decides to do the opposite of what he would normally do. It pays off for him big time as he lands a front office job with the New York Yankees (after criticizing the owner [...]

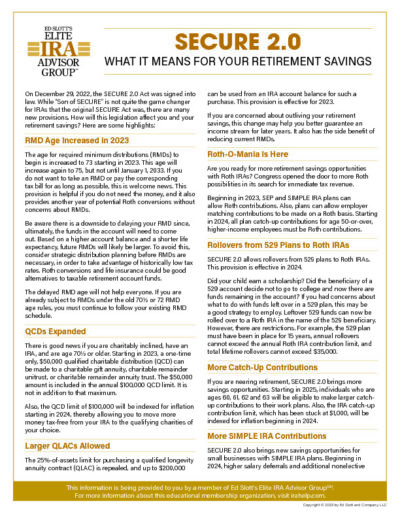

THE SECURE ACT 2.0

Here’s What It Means For You

On December 29, 2022, the SECURE 2.0 Act was signed into law. While “Son of SECURE” is not quite the game changer for IRAs that the original SECURE Act was, there are many new provisions. How will this legislation affect you and your retirement savings? Download the Guide for some highlights and effective dates.

ED SLOTT’S GUIDE LIBRARY:

Updated Monthly!

Steven J. Toto, CPF®

Proud Member of Ed Slott’s IRA Advisor Group

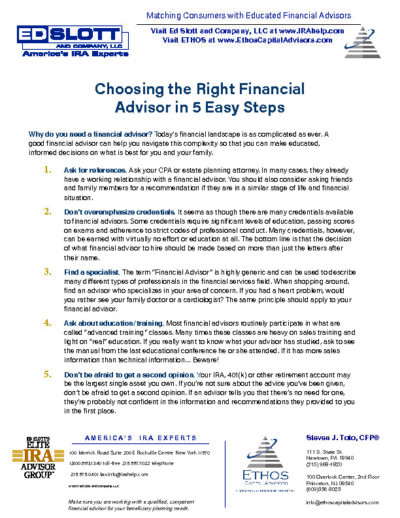

Members of Ed Slott’s Elite IRA Advisor GroupSM train with Ed Slott and his team of IRA professionals on a continuous basis. Members are immediately notified of changes to the tax code and updates on retirement planning, so you can be sure your retirement dollars are safe from unnecessary taxes and fees. Retirement planning is complicated. It is a personal and situational endeavor with possible pitfalls in the way of success. There are approximately 500 members throughout the country and Steven Toto is one of them. He is armed with current, cutting-edge IRA information to help service his clients, their families, and members of the Newtown, PA & Princeton, NJ communities. If you are interested in discussing your situation with Mr. Toto, give us a call today.

Pharmaceutical Benefit Planning

Our advisors can help you navigate the complexities of your benefit plan so you can refine your

decision-making and pursue the retirement goals you have worked hard to secure.

MERCK