ROTH 401(K)S: FIVE THINGS TO KNOW

A recent survey found that over 80% of 401(k) plans now offer employees the option of making Roth 401(k) employee contributions. More and more employees are now taking advantage of that opportunity. (In this article, I use the term “Roth 401(k) contributions” to also include Roth employees made to 403(b) [...]

DON’T OVERLOOK YOUR BENEFICIARY FORM

You have been contributing to your IRA for years. The market is up, and you are watching those investments grow. Maybe you have rolled over funds to your IRA from your company plan. You may now have a significant balance. So far, you have taken smart steps toward a secure [...]

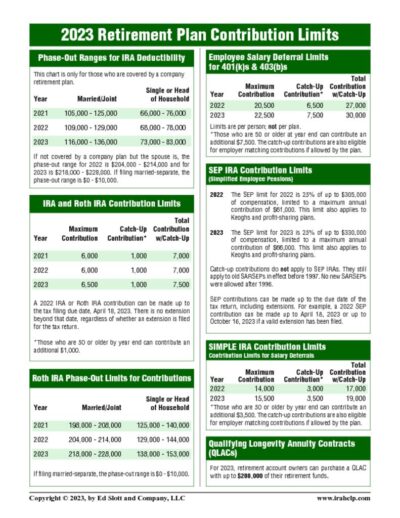

PARTICIPATION IN MULTIPLE WORK PLANS

It is perfectly acceptable for a person to participate in multiple work plans in the same year (even at the same time). For example, a 401(k) and a SEP. Or maybe a 401(k) and another 401(k). However, care must be taken to follow IRS contribution limits and other guidelines. Unfortunately, [...]

IRS BENEFICIARY RMD FINAL RULES

After more than two years, we might soon be getting answers from the IRS on several important unanswered questions concerning required minimum distributions (RMDs) for those who inherit IRAs or company plan accounts. The 2019 SECURE Act completely changed the RMD rules for many beneficiaries of retirement accounts. Previously, any [...]

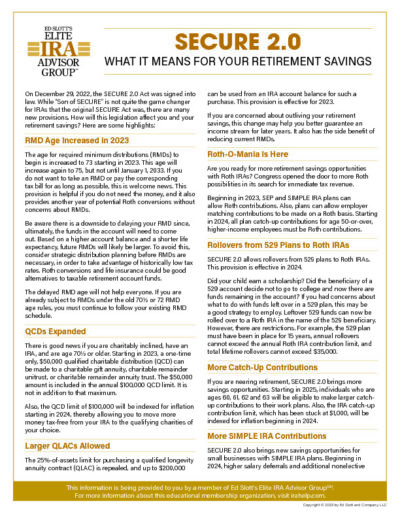

THE SECURE ACT 2.0

Here’s What It Means For You

On December 29, 2022, the SECURE 2.0 Act was signed into law. While “Son of SECURE” is not quite the game changer for IRAs that the original SECURE Act was, there are many new provisions. How will this legislation affect you and your retirement savings? Download the Guide for some highlights and effective dates.

ED SLOTT’S GUIDE LIBRARY:

Updated Monthly!

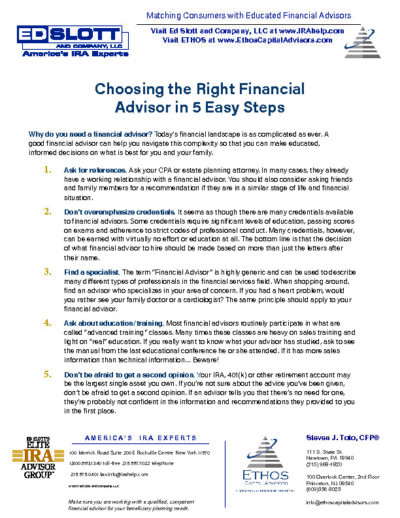

Steven J. Toto, CPF®

Proud Member of Ed Slott’s IRA Advisor Group

Members of Ed Slott’s Elite IRA Advisor GroupSM train with Ed Slott and his team of IRA professionals on a continuous basis. Members are immediately notified of changes to the tax code and updates on retirement planning, so you can be sure your retirement dollars are safe from unnecessary taxes and fees. Retirement planning is complicated. It is a personal and situational endeavor with possible pitfalls in the way of success. There are approximately 500 members throughout the country and Steven Toto is one of them. He is armed with current, cutting-edge IRA information to help service his clients, their families, and members of the Newtown, PA & Princeton, NJ communities. If you are interested in discussing your situation with Mr. Toto, give us a call today.

Pharmaceutical Benefit Planning

Our advisors can help you navigate the complexities of your benefit plan so you can refine your

decision-making and pursue the retirement goals you have worked hard to secure.

MERCK