- In-Person Events

- On-Demand Webinars

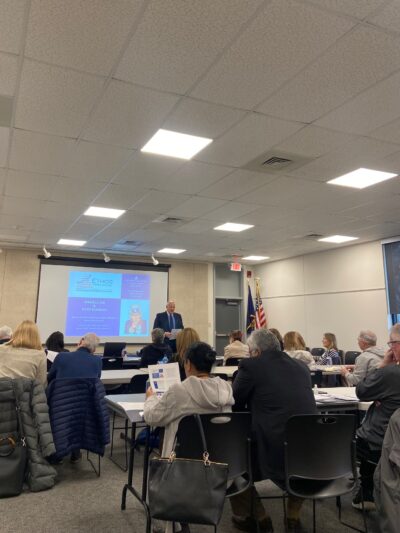

In-Person Events

July

July 31st – Newtown, PA

Retirement Literacy: Navigating Uncertainty with Confidence

Time: 6:00pm-7:00pm

Where: Grey Stone

552 Washington Crossing Rd, Newtown, PA 18940

As we approach the next election cycle, the retirement planning landscape is inevitably influenced by a multitude of factors. From evolving tax laws affecting retirement accounts to shifts in healthcare policy, and broader economic changes that could sway market performance, navigating retirement planning amidst this uncertainty requires a solid foundation of retirement financial literacy.

Join Steven J. Toto, CFP®, to put your financial literacy knowledge to the test.

July 30th – Lawrenceville, NJ

Retirement Literacy: Navigating Uncertainty with Confidence

Time: 6:00pm-7:00pm

Where: KC Prime

4160 Quakerbridge Rd, Trenton, NJ 08648

As we approach the next election cycle, the retirement planning landscape is inevitably influenced by a multitude of factors. From evolving tax laws affecting retirement accounts to shifts in healthcare policy, and broader economic changes that could sway market performance, navigating retirement planning amidst this uncertainty requires a solid foundation of retirement financial literacy.

Join Steven J. Toto, CFP®, to put your financial literacy knowledge to the test.

July 10th – Yardley-Makefield Branch, Bucks County Free Library, Yardley PA

Retirement Literacy: Navigating Uncertainty with Confidence at 6pm

June

June 27th –Mercer County Library: West Windsor Branch, West Windsor NJ

Retirement Literacy: Navigating Uncertainty with Confidence at 1pm and 6pm

June 26th – Yardley-Makefield Branch, Bucks County Free Library, Yardley PA

Retirement Literacy: Navigating Uncertainty with Confidence at 1pm and 6pm

June 19th – Grey Stone, Newtown PA

Retirement Literacy: Navigating Uncertainty with Confidence

June 18th – KC Prime Restaurant Steakhouse, Lawrenceville, NJ

Retirement Literacy:Navigating Uncertainty with Confidence

April

April 17th – KC Prime Restaurant Steakhouse, Lawrenceville, NJ

Retirement Literacy: RETIREMENT FINANCIAL LITERACY

March

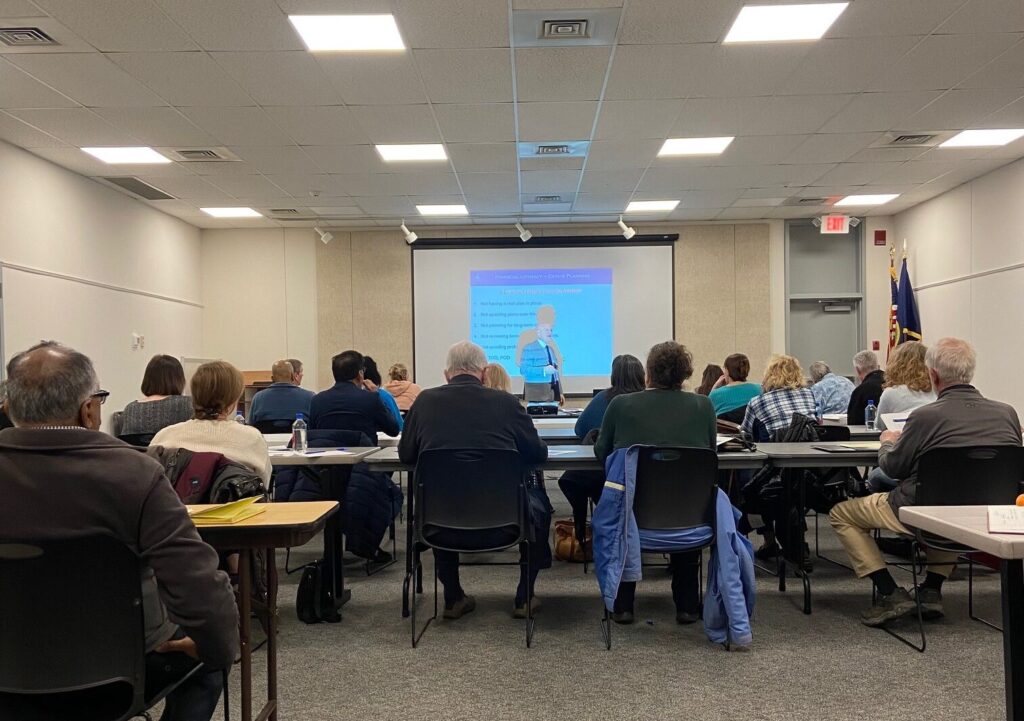

March 26th –Yardley-Makefield Branch, Bucks County Free Library, Yardley, PA

March 27th – Mercer County Library: Lawrence Headquarters Branch, Lawrence Township, NJ

Retirement Literacy: TAXES, INFLATION, & MARKET VOLITILITY

AM & PM SESSIONS

March 11th – The Yardley Inn, Yardley, PA

March 12th – KC Prime Restaurant Steakhouse, Lawrenceville, NJ

Retirement Literacy: FINANCIAL LITERACY

February

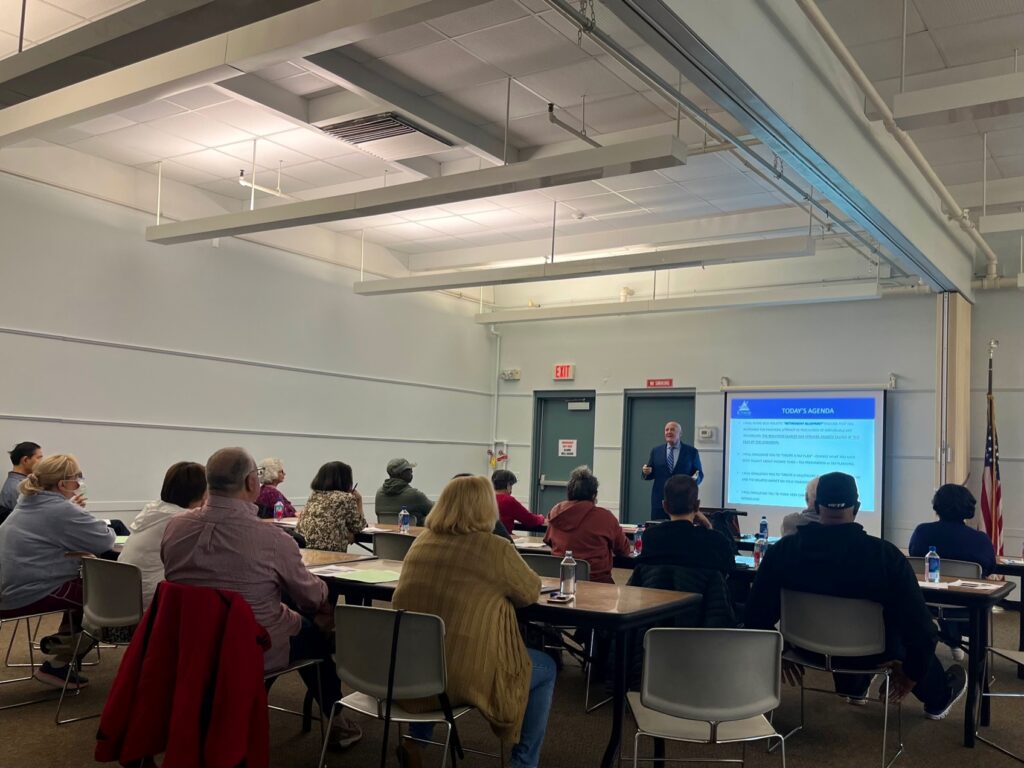

February 20 – Yardley-Makefield Branch, Bucks County Free Library, PA

February 21 – Plainsboro Public Library, NJ

Retirement Literacy:TAXES, INFLATION & MARKET VOLATILITY

AM & PM SESSIONS.

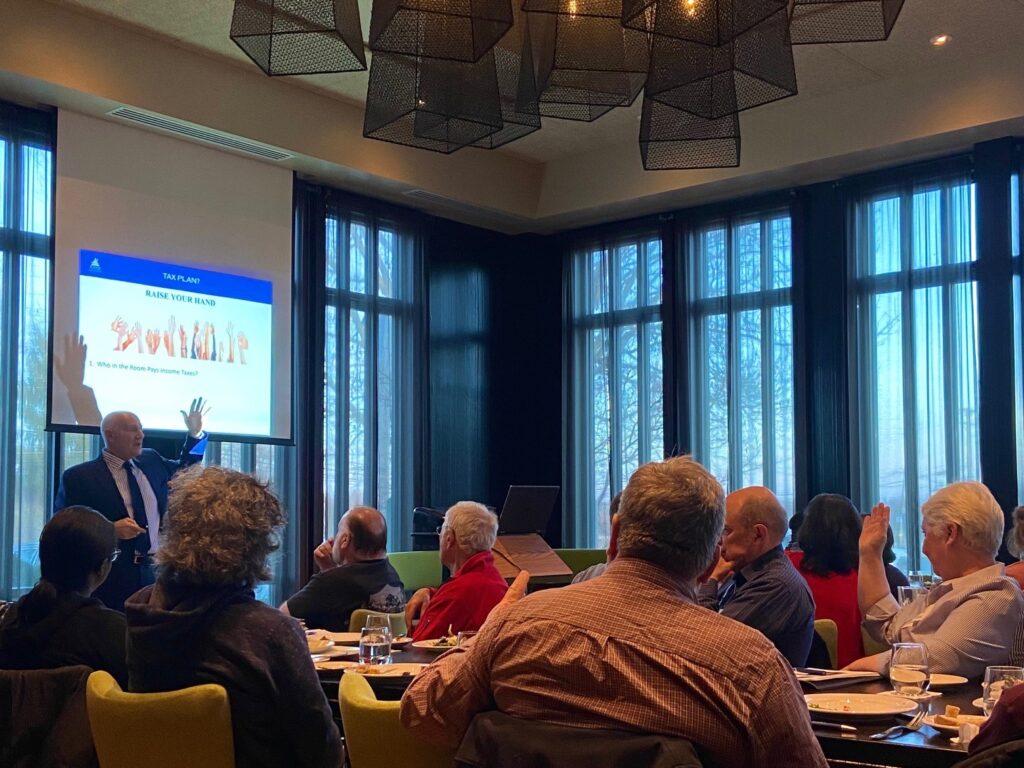

February 6 – Ruth’s Chris Steakhouse Princeton, NJ

February 7 – Grey Stone Newtown, PA

Retirement Literacy: 2024 TAX-EFFICIENT RETIREMENT STRATEGIES

January

January 8 – Ruth’s Chris Steakhouse Princeton, NJ

January 10 – Grey Stone Newtown, PA

Retirement Literacy: 2024 TAX-EFFICIENT RETIREMENT STRATEGIES

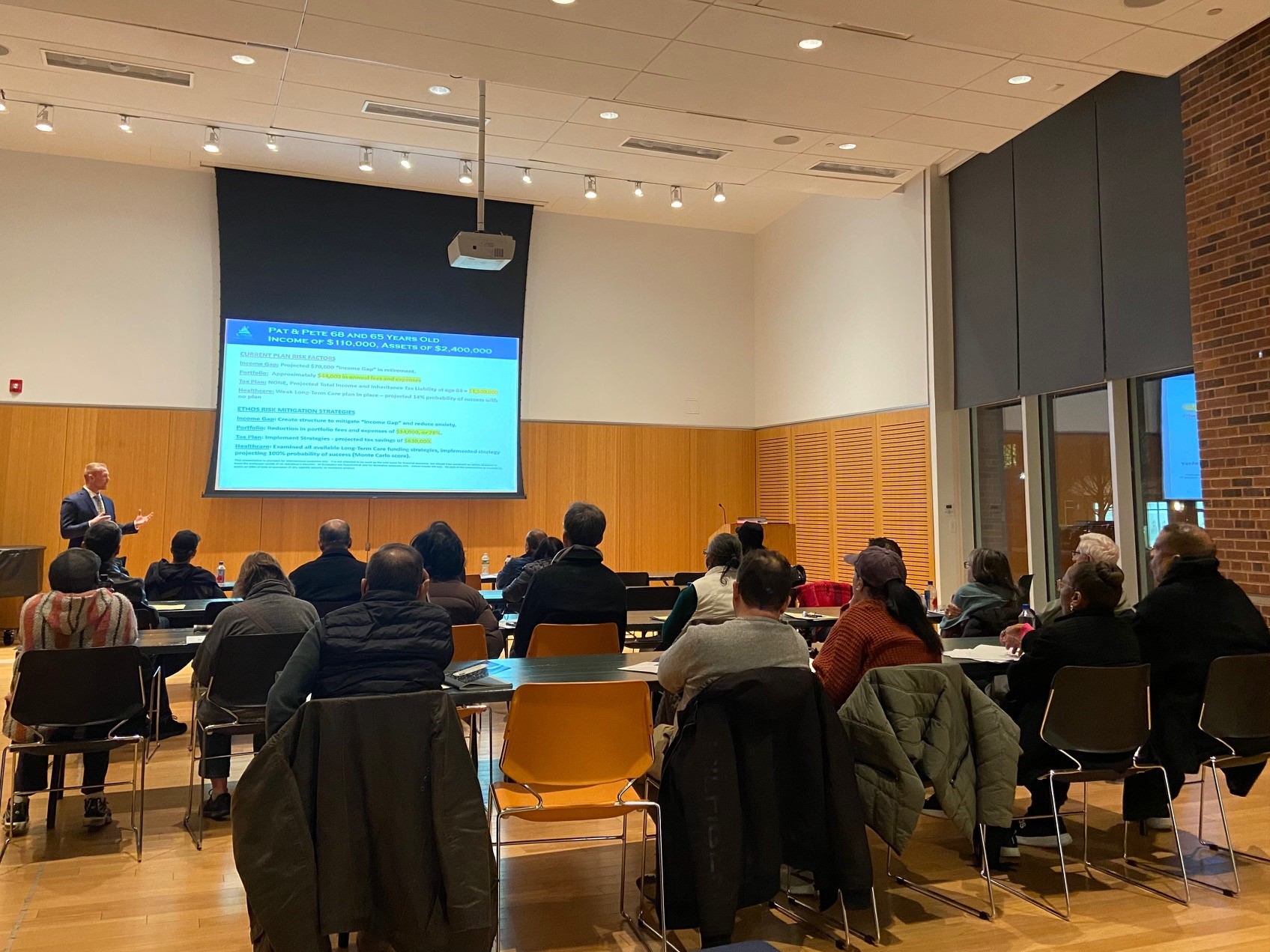

Previous Events 2023

November

November 6: 2 pm & 6 pm sessions – Richboro, PA

Retirement Literacy: TAXES, INFLATION, AND MARKET VOLATILITY

October

October 9 – Ruth’s Chris Steakhouse Princeton, NJ

October 10 – Grey Stone Newtown, PA

Retirement Literacy: ESTATE + YEAR-END TAX PLANNING

September

September 12 – Ruth’s Chris Steakhouse Princeton, NJ

September 13 – Grey Stone Newtown, PA

Retirement Literacy: ESTATE + YEAR-END TAX PLANNING

July

July 18 – Ruth’s Chris Steakhouse Princeton, NJ

July 19 – Grey Stone Newtown, PA

Retirement Literacy: DE-RISK YOUR RETIREMENT

June

June 19 – Ruth’s Chris Steakhouse Princeton, NJ

June 20 – Grey Stone Newtown, PA

Retirement Literacy: PROACTIVE TAX & ESTATE PLANNING

April

April 24 – Ruth’s Chris Steakhouse Princeton, NJ

April 25 – Grey Stone Newtown, PA

Retirement Literacy: PROACTIVE TAX & ESTATE PLANNING

March

March 20 – Hamilton Public Library, NJ

March 21 – Yardley Makefield Township Library, PA

Retirement Literacy: PROACTIVE TAX & ESTATE PLANNING

February

February 22 – Yardley Makefield Township Library, PA

February 23 – Plainsboro Public Library, NJ

Retirement Literacy: PROACTIVE TAX & ESTATE PLANNING

January

January 24 & 25 – Ruth’s Chris Princeton, NJ

January 26 Lunch & Dinner – Grey Stone Newtown, PA

Retirement Literacy: STRATEGIC TAX & ESTATE PLANNING

On-Demand Webinars

Fill out below to RSVP!