The choice between value and growth as interest rates decline is not clear-cut.

In the ever-evolving world of investing, the perennial debate between growth and value continues to captivate the minds of investors. As we venture into 2024, a pressing question looms large: Will growth once again reign supreme over value, especially in the context of the widely anticipated decline in interest rates? The answer, it seems, lies in the peculiar turn of events witnessed in 2023.

Defining Value and Growth

Investors traditionally categorize stocks into two main groups: value and growth. Value stocks typically represent well-established companies with stable profits, trading at a discount to their intrinsic worth. These companies often boast reliable, sustainable business models and are known for paying dividends due to their consistent cash flows, including sectors like banks, healthcare, and industrials.

On the other hand, growth stocks are seen as entities with the potential to outperform the market in the future, even if they may currently be unprofitable or expensive. These stocks are riskier and more volatile, emphasizing innovation and future growth prospects, commonly found in Information Technology and Consumer Discretionary sectors.

The Role of Interest Rates

One prevailing theory shaping investor sentiment suggests that rising interest rates are detrimental to growth stocks relative to value stocks. The rationale behind this theory lies in the calculation of stock prices, factoring in the present value of future earnings. As interest rates rise, the present value of future earnings decreases, impacting growth stock prices more negatively.

Conversely, the theory suggests that value stocks may be more resilient during periods of declining rates. This is based on the idea that companies with established profitability, solid fundamentals, and dividend payments have predictable cash flows and may benefit from lower borrowing costs, potentially enhancing their financial performance.

The Unexpected Events of 2023

The events of 2023 challenged this established theory. Despite a continuous increase in interest rates throughout the year, US growth stocks significantly outperformed US Value Stocks. The S&P 500 Growth Index, dominated by tech-heavy companies, outpaced its Value Index counterpart by a notable 7.82 percentage points, dividends included. This stark contrast to the expected performance during a period of rising interest rates raises the pivotal question: Was growth’s outperformance an exception or a new norm?

The Intrigue of 2024

The intrigue deepens as we consider the anticipated decline in interest rates for 2024. Conventional wisdom suggests that this should herald another favorable year for growth stocks relative to value. However, the lessons from 2023 remind us that markets are unpredictable, and historical patterns may not always hold.

The Magnificent 7

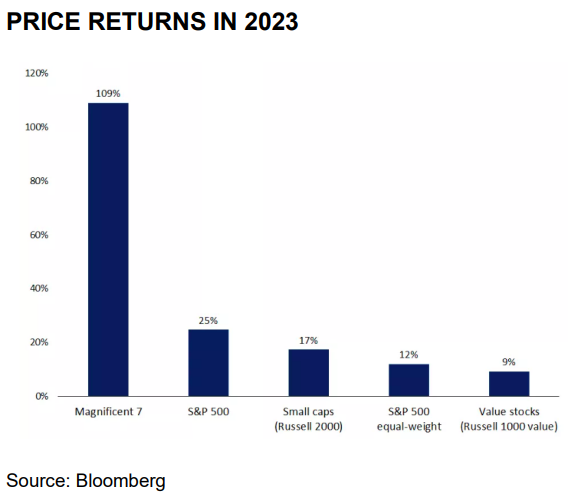

In the dynamic world of investing, the spotlight shines on the “Magnificent 7” — industry giants Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla. In 2023, these behemoths played a pivotal role in concentrated market leadership, contributing to a staggering 90% of the S&P 500 gains by the year’s midpoint. The dominance of these tech giants challenges traditional sector diversification strategies and sparks questions about the sustainability of such concentrated market leadership.

A Glimpse at Price Returns in 2023

However, the market landscape is far from one-dimensional. Despite the overwhelming influence of the Magnificent 7, growth stocks have showcased remarkable resilience in the face of both rising and declining interest rates. Traditionally perceived as more vulnerable during periods of rate hikes, the events of 2023 challenged this perception. The focus on future growth prospects and investors’ willingness to tolerate higher valuations positioned growth stocks as dynamic assets that can adapt and flourish, even when faced with headwinds such as rising interest rates.

Similarly, value stocks have proven their resilience in both rising and declining interest rate environments. During periods of rising rates, well-established companies with stable profits, often found in the value category, have demonstrated their ability to navigate economic challenges. Moreover, during times of declining interest rates, value stocks can benefit from lower borrowing costs, potentially enhancing their financial performance. The focus on intrinsic value and consistent dividend payments makes value stocks an attractive choice for investors seeking stability and a reliable income stream, showcasing their ability to adapt to various economic scenarios.

Striking a Balance in a Shifting Landscape

As investors navigate the complex terrain of declining interest rates, the key lies in striking a balance. Diversification remains a cornerstone of sound investment strategy. A well-balanced portfolio that combines both value and growth stocks can help mitigate risks and capitalize on opportunities across different market conditions.

The reality is that the debate between value and growth investing in a declining interest rate environment is not a clear-cut choice. The lessons from history remind us to approach market dynamics with flexibility and an open mind. Ultimately, the best strategy may lie in a nuanced approach that considers the unique strengths and potential pitfalls of both value and growth investing in the ever-changing financial landscape.

Approaching 2024 with Cautious Optimism

The market performance witnessed in 2023 prompts us to approach 2024 with cautious optimism, recognizing that the market’s twists and turns may defy conventional wisdom. As we grapple with these uncertainties, one thing is certain — the world of investing is a fascinating journey where adaptability and a keen eye for emerging trends are the keys to success. In a landscape dominated by the Magnificent 7, staying nimble and open to diverse investment strategies will be essential for investors seeking to navigate the complexities of the evolving financial markets.