Getting ready for retirement involves more than just calculating how much you will need and the rate you can draw down your savings. The years before you retire, and the first few years of retirement, are crucial times to prepare both financially and psychologically, especially in the presence of volatility.

Often – and unfortunately – many retirees underestimate their expenses, don’t address their risk tolerance, and panic over market corrections among other variables. Especially when the media is shouting about bank failures, historically high inflation numbers, a ballooning national debt, a hawkish Federal Reserve, and countless predictions of a looming recession.

Here are a few exercises that you can take to get ready for the reality of retirement.

Know Your Retirement Expenses

Test the retirement expense waters. Generally speaking, when financial advisors hear stories about people who run out of money in retirement, it has little to do with market actions or portfolio losses. Most retirees often underestimate expenses both during the planning process and in retirement. People just seem hardwired to believe that they spend less than they actually do. A good recommendation for you is to test your estimate out and actually live your retirement spending plan before you retire.

While you are working, it is possible to fudge this a bit, and many people do. But under-estimating income needs may become a big problem when you try to maintain reasonable withdrawal ratios in retirement that may enable your future income to grow, adjusting for inflation.

If you plan ahead and take the time to make sure you can actually live on your assumed expense amount, you might avoid a lot of problems. If it turns out that you have a hard time living within your planned spending allowance, then you need to take action before you retire or work a few years longer.

Have a Plan

Most Americans lack a Written Financial Retirement Plan. Instead of operating in the dark, a written plan will explore and address:

- Your income in retirement.

- The efficiency of your investment plan and fee structure.

- Implementation of a proactive tax plan, if opportunities exist.

- Healthcare options.

- An estate plan that will meet your wants and needs.

A Written Financial Retirement Plan is a comprehensive review that mathematically analyzes and tests your current plan for success. For a complimentary written plan, call us today at (215) 968-1820.

Run Stress Tests

Expect the worst from the markets and be ready. Ideally, you should live mainly off the growth of your portfolio and draw it down as slowly as possible. Your plan should keep your yearly withdrawal rate below 5% of your total assets.

To keep the portfolio growing enough to stay even with the rising cost of living, in normal times, you need at least 3% returns from the markets. But in the last few years, that number has jumped way up, more than tripling. But don’t count on getting either of those. There is no investment or strategy that can provide returns with anything resembling a guarantee. Expect to suffer volatility and setbacks. The only thing we can do is prepare ourselves and maintain cash on the sidelines.

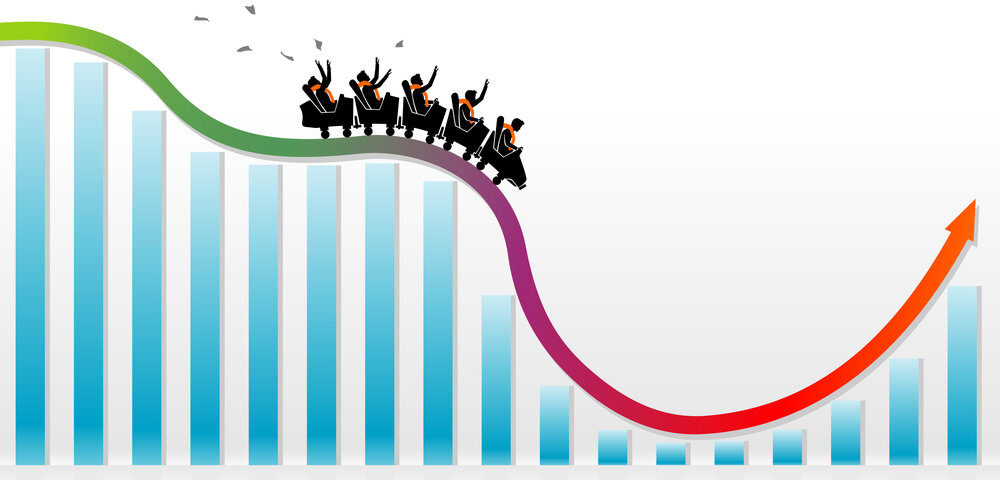

Long-term market returns rarely fail investors, but short-term investor reaction very often does. Every rolling 10-year period between 1927 and the present day had an average 10-year return close to double digits. The same holds true for 30-year rolling periods. Over the long run, a balanced portfolio always comes out okay. Just resist the urge to sell in panic during a downturn.

History shows that we should expect and prepare for such a situation. There have been more than a dozen bear markets since the end of World War II. The average loss during these periods was about 30%. But these episodes merely punctuate a long-term trend that drove the Standard & Poor’s 500 up enormously. And the index paid out about 2% in average dividends every year along the way. So, don’t believe it next time the pundits say this time is different and the world is ending.

Stick to your plan.