In the dynamic world of investment strategies, few have captured the attention and loyalty of investors as much as the ‘Dogs of the Dow.’ This seemingly simple yet intriguing concept has been a source of fascination for decades, enticing investors with its promise of consistent returns. In this article, we will delve into the history, principles, and considerations surrounding this popular investment approach, especially in the aftermath of a prosperous year for the Dow Jones Industrial Average in 2023, which saw a remarkable increase of almost 14%.

History and Foundation

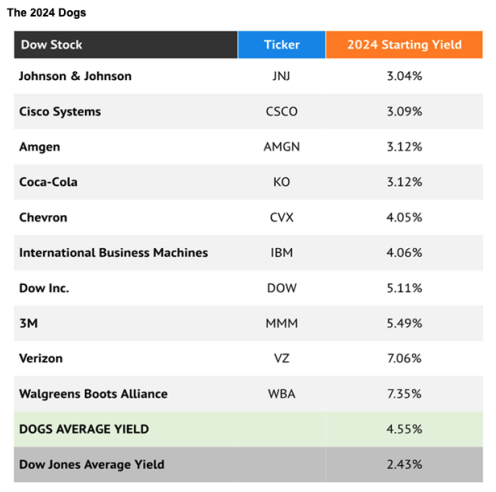

The Dogs of the Dow strategy traces its roots back to the early 1990s and is credited to Michael O’Higgins, a respected finance author. The concept revolves around selecting and investing in high-dividend-yielding stocks within the 30-stock Dow Jones Industrial Average. The methodology is straightforward: at the beginning of each year, investors identify the 10 highest-yielding stocks from the Dow’s thirty constituents. The idea is to allocate an equal amount of capital to each of these 10 stocks and hold onto them for the entire year.

The underlying rationale is grounded in the belief that blue-chip companies with robust fundamentals tend to offer higher dividend yields when their stock prices are relatively low. The assumption is that these stocks, being temporarily undervalued, have the potential for capital appreciation throughout the year, making them favorable selections for investment.

But After a Year of Great Performance?

The question that arises is whether the Dogs of the Dow strategy is prudent after a year of substantial growth in the Dow Jones Industrial Average, similar to what was experienced in 2023. Historically, the strategy has demonstrated resilience and consistency in various market conditions. However, after a bullish year for the Dow, certain considerations come into play.

Following a bullish market, some of the stocks that constituted the Dogs of the Dow might have appreciated significantly, leading to a reduction in their dividend yields. Consequently, these once-high-yield stocks might no longer feature among the top 10. Investors keen on deploying this strategy post a robust market year might find themselves facing altered dynamics in stock selection.

Moreover, market conditions, economic factors, and individual stock performances significantly impact the strategy’s efficacy. It is essential to conduct thorough research and analysis to ascertain the current positioning of high-dividend-yielding stocks within the Dow Jones Industrial Average.

Considerations and Caution

While the Dogs of the Dow strategy boasts a straightforward methodology and a historical track record, it is crucial to approach it with a comprehensive understanding of its limitations and risks. Past performance is not indicative of future results, and market dynamics can shift unexpectedly.

Various factors such as economic conditions, changes in interest rates, company-specific issues, and broader market trends can influence the performance of these stocks. Additionally, the approach might entail concentrated exposure to specific sectors or industries, thereby increasing vulnerability to sector-specific risks. Diversification remains a fundamental principle in investment, and investors should exercise caution when considering a strategy that concentrates investments in a limited number of stocks.

Make Informed Investment Decisions

The Dogs of the Dow strategy, with its historical allure and simple methodology, continues to captivate investors seeking a systematic approach to investing. Its effectiveness, however, hinges on various factors, including market conditions, individual stock performances, and economic landscapes.

After a strong year for the Dow Jones Industrial Average, investors contemplating this strategy should approach it with meticulous research and adaptability. Monitoring the current dividend yields, evaluating the financial health of companies, and considering broader market trends are crucial components of implementing this approach successfully.

Ultimately, while the Dogs of the Dow strategy holds appeal for its simplicity and historical performance, prudent investors should exercise due diligence and supplement it with comprehensive market analysis to make informed investment decisions. Consulting with a financial advisor can provide valuable insights and guidance in navigating the complexities of this strategy.