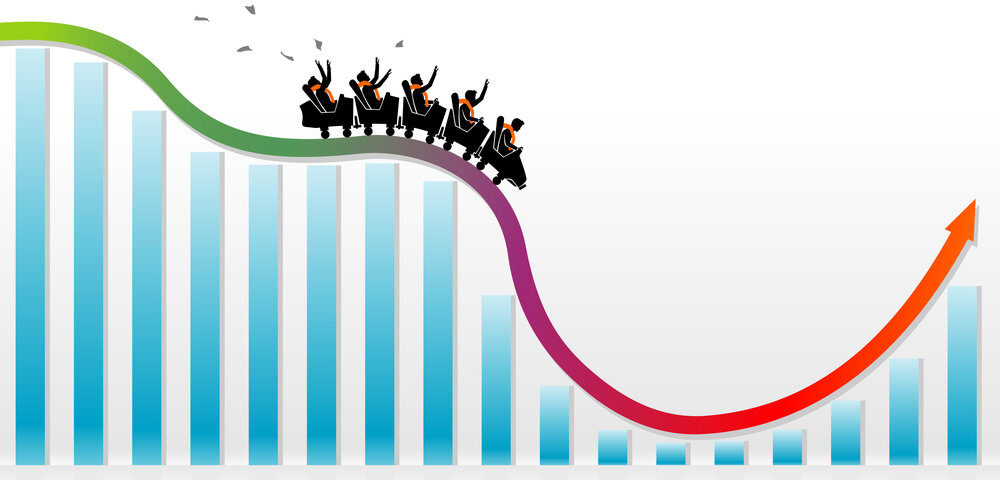

Since the beginning of the year, economists and pundits seem united in believing that economic growth will continue to contract. This contraction will propel inflation and interest rates to levels that we haven’t seen in years. When the Federal Reserve lifts the fed funds rate again – likely on the way to 4.00% – holders of CDs and money market funds will likely benefit.

On the other hand, higher rates and inflation indicate peril for bonds and for stocks with high dividend yields. The yield on the 10-year Treasury bond soared from less than 1.0% in the summer of 2021 to almost 3.4% in mid-September 2022, causing the bond’s price to drop. Who would blame you if you’re not a fan of Treasury bonds? Although they’re very safe from a credit-quality perspective, they still pay too little and are highly vulnerable to rising rates, as their recent performance shows.

Over in the stock market, utilities, telecommunications, and other high-yielding groups have lagged. However, remember this: dividend-paying stocks can reduce your overall volatility as dividends can often offset price declines.

What Makes a Dividend Attractive?

Why can dividend-paying stocks help reduce volatility and offset price declines? Well, consider that according to the Stock Trader’s Almanac, since 1945 reinvested dividends have contributed 33% of the total return in the S&P 500. In other words, maybe you could improve your performance by a third without doing a thing.

Did you know that about 80% of the companies in the S&P 500 – that’s 400 companies – already pay some form of dividends? In fact, the current yield as of mid-September on the S&P 500 is 1.69% (in August the S&P 500’s yield was 1.37%).

Other places to consider looking for dividends include utilities and REITs, which have historically (as a group) paid dividends. Remember, REITs must distribute at least 90% of their taxable income to shareholders as dividends. Perhaps the best recipe for the year ahead will be to mix growth with income.

Finally, let’s not forget the power of compounding. As Ben Franklin famously said,

“Money makes money. And the money that money makes, makes money.”