Powell’s comments suggest the Fed is likely to raise rates higher and faster

The Federal Reserve, commonly referred to as the Fed, plays a crucial role in the U.S. economy. In fact, technically speaking, since the late 1970s, the Fed has had a dual mandate from Congress – to pursue the economic goals of 1) maximum employment and 2) price stability. The most important tool available to the Fed is its ability to set the federal funds rates, or the prime interest rate. Interest is, basically, the cost to the banks of borrowing someone else’s money. The banks will pass on this cost to their own borrowers.

As a way to boost the economy, remember that the Fed set its benchmark interest rate close to zero in late 2008 and did the same thing at the beginning of the COVID pandemic. This resulted in “free money.” By reducing the federal funds rate, the Fed increased the supply of money by making it less expensive to obtain. As a result, businesses could have greater access to money. Additionally, they could spend more on building their businesses and on hiring more employees. Because consumers and businesses had more money, they could purchase more goods, services, houses, and stocks.

Increasing the federal funds rate, on the other hand, reduces the supply of money by making it more expensive to obtain. Reducing the amount of money in circulation, by decreasing consumer and business spending, helps to reduce inflation. However, the Federal Reserve has to decide whether the increase in consumer demand and in hiring has led to enough inflation in prices to warrant a reduction in rates.

A Long Way to Go

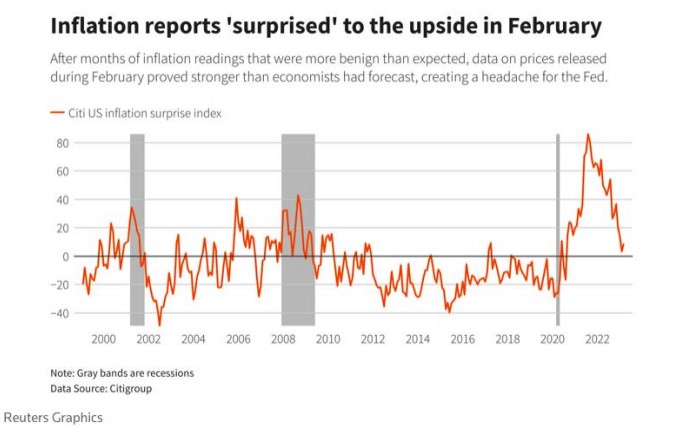

“The process of getting inflation back down to 2% has a long way to go and is likely to be bumpy,” Powell told the Senate Banking Committee. “As I mentioned, the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

And while the Fed’s funds rate is currently sitting at 4.75% – 5.00%, there are plenty of economists suggesting that the Fed funds rate might peak closer to 5.5% – 6.0%.

The reason? Stubbornly high inflation.

The Fed & Consequences

Any increased expense for the banks to borrow money has a ripple effect, which influences both individuals and businesses in their costs and plans.

Effect on individuals

Banks increase the rates that they charge to individuals to borrow money, through increases to credit card and mortgage interest rates. As a result, consumers have less money to spend. They must face the effect on what they want to purchase and when to do so.

Effect on business

Because consumers have less disposable income, businesses must consider the effects to their revenues and profits. Businesses also face the effect of the greater expenses of borrowing money. As the banks make borrowing more expensive for businesses, companies are likely to reduce their spending. Less business spending and capital investment can slow the growth of the economy, decreasing business profits. These broad interactions can play out in numerous ways.

The stock market as a whole

Stock prices decrease when investors see companies reduce growth spending or make less profit. Absent other economic effects, the value of stocks in general will fall.

Bond Market

As the stock market drops, investors tend to view the risk of stock investments as outweighing the rewards. They will often move toward safer bonds and Treasury bills. As a result, bond interest rates will generally rise, and investors will likely earn more from bonds.

The U.S. Dollar

If the Fed hikes interest rate, then the U.S. Dollar appreciates. A stronger dollar means that U.S. consumers pay less for imports and will boost U.S. demand for products from Asia and Europe.

The federal budget

The U.S. government has a very large debt, and increased interest rates lead to higher interest payments.

Corporate borrowers

Companies that are repaying loans will end up with higher interest payments.

Mortgage holders

Payments on mortgage interest will increase for individuals and companies whose mortgages do not carry a fixed interest rate.

The Impact on Investors

Obviously, many factors affect activity in various parts of the economy. A change in interest rates, although important, is just one of those factors. And while many factors can affect the market, it is important to prepare for any effects on your business, your livelihood, and your investment portfolio when an increase in the federal funds rate does take place. Be sure to talk to your financial advisor for specific guidance.