The vital role of inflation in financial planning for beneficiary’s college expenses.

In today’s rapidly evolving economic landscape, effective financial planning has taken on unprecedented importance. When it comes to saving for your beneficiary’s college education, accounting for inflation is a fundamental college cost consideration that cannot be underestimated.

Inflation, characterized by the gradual escalation in the costs of goods and services over time, possesses the potential to gradually erode the purchasing power of your money if it is not thoughtfully incorporated into your financial strategy.

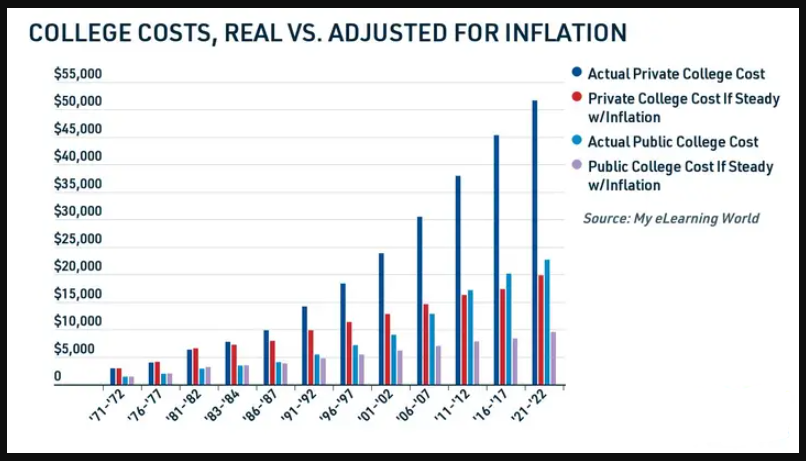

The Escalating College Cost, Compared to Inflation

Did you know that in 1980, the annual cost of attending a four-year college full-time, inclusive of tuition, fees, room and board, and adjusted for inflation, stood at $10,231, as reported by the National Center for Education Statistics? Fast forward to the 2019-20 academic year, and that figure surged to $28,775—an astonishing 180% increase over the span of these years.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

Preserving Your Financial Strength

Consider this scenario: You embark on a journey to save for your child’s college education from the moment they are born. Over the ensuing 18 years, you diligently accumulate a substantial sum. However, if inflation maintains an average annual rate of 3%, the cost of a college education could potentially double over that period. Failing to account for inflation might leave you with savings that fall far short of meeting the actual expenses when your child is ready for enrollment.

By incorporating inflation into your financial planning, you safeguard the purchasing power of your savings. In essence, you future-proof your investments, ensuring they maintain their value over time. This proactive approach secures your capacity to address escalating expenses without compromising the quality of your child’s education.

Setting Realistic Goals

Incorporating inflation into your financial planning aids in establishing realistic objectives. When preparing for a future expense like college, comprehending the genuine cost is crucial. Ignoring inflation can lead to underestimating the required savings amount, potentially culminating in long-term financial stress.

Accurate Accounting for Inflation

When you accurately factor in inflation, you gain a precise understanding of the sum necessary to cover college expenses. This empowers you to allocate your resources judiciously, thereby minimizing the risk of falling short and maximizing the likelihood of attaining your financial goals.

Mitigating Financial Stress

At the core of financial planning lies the goal of reducing financial stress and cultivating peace of mind. Inflation, when unaddressed, can disrupt this aspiration. Unforeseen spikes in expenses can lead to last-minute financial challenges, potentially compelling you to compromise on the quality of your child’s education or accumulate substantial debt.

By accounting for inflation, you adopt a proactive stance in your financial planning. You prepare for the uncertainties of the future, safeguarding your child’s educational aspirations from the constraints of financial pressures.

The Significance of Planning

Financial planning is an all-encompassing process that demands careful consideration of numerous variables, with inflation holding a pivotal position. When saving for your beneficiary’s college expenses, factoring in inflation becomes essential for preserving the purchasing power of your money, establishing attainable goals, harnessing the advantages of compounding, and mitigating potential financial stress.

Incorporating inflation into your financial strategy represents a proactive stride toward securing your beneficiary’s education and your family’s financial future. Keep in mind that time is on your side, and making informed financial decisions early can be the linchpin to realizing your goals.