Planning can help turn a stressful retirement into a successful one.

The day before the AFC and NFC Championships were played, ESPN broke the news that Tom Brady was officially retiring from football. Well, it was later reported that Brady told the Tampa Bay Bucs he’s still not sure what he will do next year.

When helping people get ready for retirement – whether you’re a decorated NFL quarterback or not – the same issues generally come up over and over. Planning can spell the difference between a successful retirement with enough money and a stressful one with difficult decisions that you don’t want to make.

As such, in a nod to Tom Brady’s seven Super Bowl rings (at least for now), here are seven suggestions that Brady – and anyone else contemplating retirement – should think about.

1. Understand Social Security. The goal with Social Security is not to get the most you can from the government in your lifetime. It is to optimize the amount you receive per month when you finally retire.

The earliest age you can start Social Security is 62. If you retire at 55 or 60, then you might want to claim it as early as you can. But if you plan to work past 70, like many of us do, there is no reason to take Social Security before then. Doing so reduces the amount you can receive at your full retirement age (67 for workers born in 1960 or later). You can have a very nice bump in your benefits every year you postpone taking Social Security. That bump is often a better deal for you than starting early and taking the most money you can.

2. Are you going to work after you retire? Your retirement might not be retirement. It could be about doing something different. For you, this might mean you take on part-time work, perhaps in the industry, you spent decades in, or in an entirely different field. It brings extra money and occupies your time. If this is what you want, then factor it into your plan. Hopefully, if you decide to work, it’s because you want to, not because you are short on income and must. That’s where the strength of your regular savings comes in.

3. What happens if you get sick? No one likes to think about it, but a major illness can upset even the best financial plan. You need to consider what will happen to your life if you are incapacitated. Medicare doesn’t cover all your healthcare expenses, like nursing homes. There’s a good chance that you need to pay for uncovered extras but lack sufficient income during the worst of your illness. What would you do if that occurs?

4. Where do you plan to live? The place you spent your working years may be too costly in retirement. Plenty of lists exists of good locales to move to. What if you owned a business that didn’t do as well as you planned, and you sold it for less money than you expected? You could move to a less expensive state, where you could continue to live as comfortably as before. In other words, you get in front of the problem.

Uprooting your household might cause you some inconvenience, but maybe not so much that you must seriously change your lifestyle.

5. You’re going to feel funny not working. Not going to work every day takes some adjusting. You might feel lonely. Your phone is going to ring much less. The people you spent tons of time with just fall off the map. You might feel that no one likes you. It’s called the retirement blues. You might think you are prepared for all those newly empty hours, but most retirees are not.

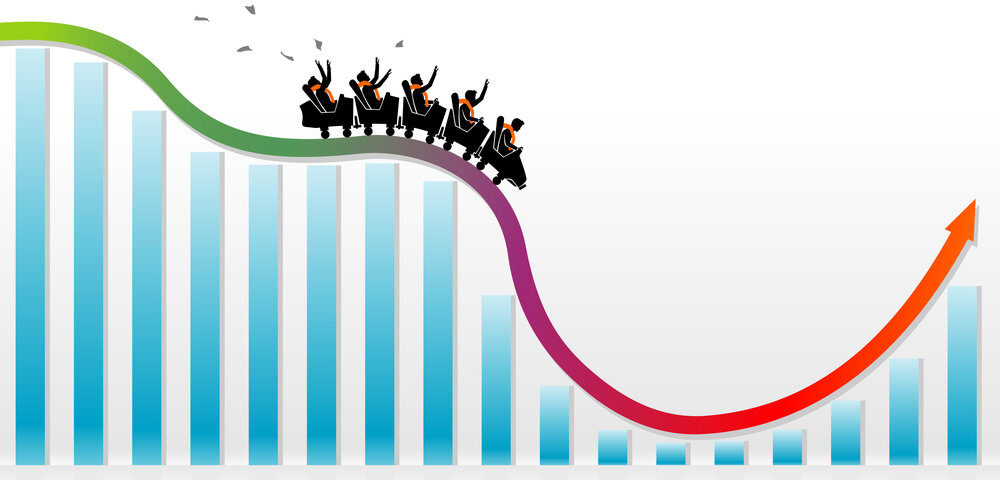

6. Timing could make or break you. If the market melts down in the first few years of retirement, you likely have much less money than you planned, and you must spend your nest egg faster than you expected. It is only good planning to stress-test your finances by assuming you lose money at the outset of retirement.

7. Do a financial plan. You need one to prepare for the best – and the worst possible – outcomes. Part of that process is scenario analysis that gives you an idea of how much you stand to lose under the worst case. Test your portfolio to make necessary adjustments. You might decide to postpone retirement, or to change your retirement goals.

Doing a financial plan once is not enough. Every few years, you need to dust off the plan and go through the tests all over again. What you don’t want is to get to retirement and find out your assumptions never came true. That is unless you like potentially nasty surprises.

Your Financial Advisor

Remember this: when you plan for retirement, you model out your financial expenses and lifestyle choices. But just because you’re close to retiring, it doesn’t mean that your planning stops.